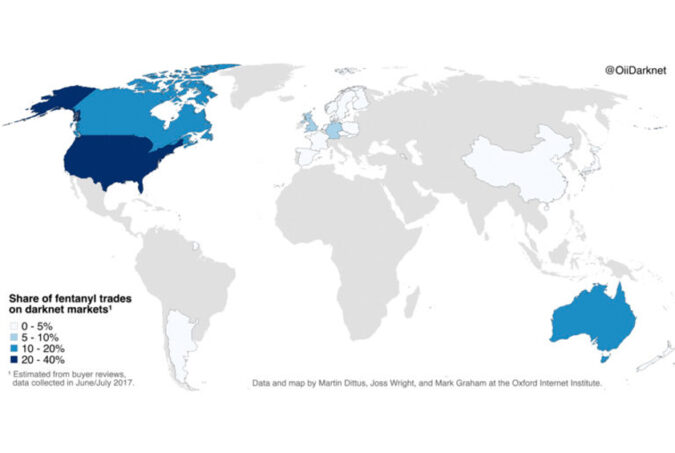

There has been a resurgence of interest in recent years in setting policies for digital platforms and the challenges of platform power. It has been estimated that there are over 120 public inquiries taking place across different nation‐states, as well as by supranational entities such as the United Nations and the European Union. Similarly, the current surge in enquiries, reviews and policy statements concerning artificial intelligence (AI), such as the Biden Administration’s Executive Order on Safe Secure and Trustworthy Artificial Intelligence in the U.S., the U.K.’s AI Safety Summit and the EU AI Act, also speak to this desire to put regulatory frameworks in place to steer the future development of digital technologies. The push for greater nation‐state regulation of digital platforms has occurred in the context of the platformisation of the internet, and the concentration of control over key functions of the digital economy by a relatively small number of global technology corporations. This concentration of power and control is clearly apparent with artificial intelligence, where what the U.K. House of Commons Science, Innovation and Technology Committee referred to as the access to data challenge, with ‘the most powerful AI needs very large datasets, which are held by few organisations’, is paramount (House of Commons Science, Innovation and Technology Committee, 2023, p. 18). As a result, the extent to which the political of platform governance appears as a direct contest between corporate and governmental power is clearer than was the case in the early years of the open Internet. In my Policy & Internet paper, “Mediated Trust, the Internet and Artificial Intelligence: Ideas, interests, institutions and futures”, I argue that trust is a central part of communication, and communication is central to trust. Moreover, the nature of that connection has intensified in an age of universal and pervasive digital media networks. The push towards nation‐state regulation of digital platforms has come from the intersection of two trust vectors: the…

Trust is a critical driver for AI adoption. If people do not trust AI, they will be reluctant to use it, writes Professor Terry Flew.