Digital platforms strongly determine the structure of local interactions with users; essentially representing a totalitarian form of control. Image: Bruno Cordioli (Flickr CC BY 2.0).

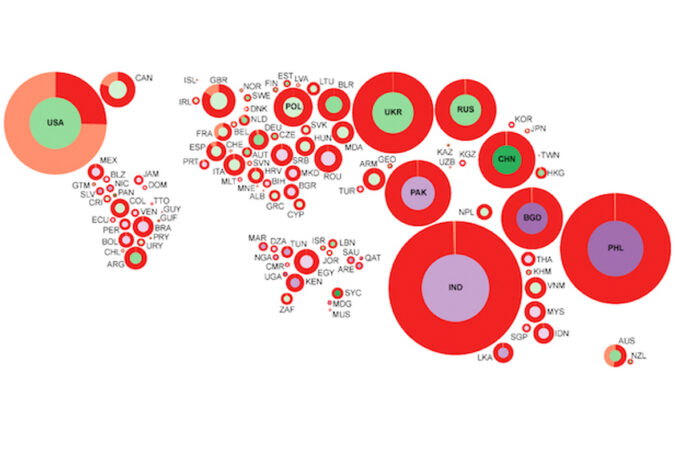

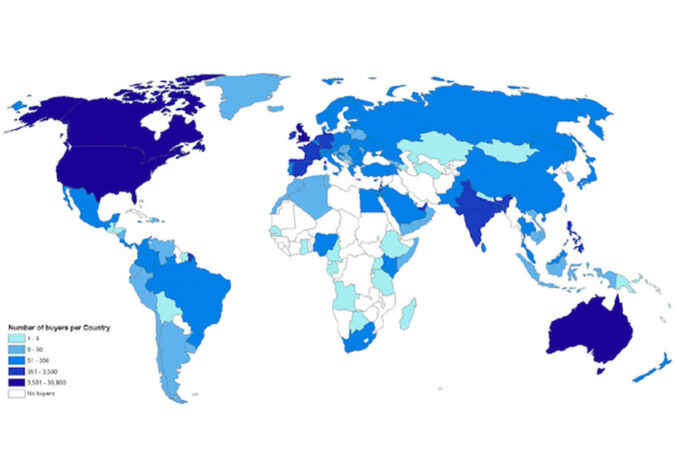

Digital platforms are not just software-based media, they are governing systems that control, interact, and accumulate. As surfaces on which social action takes place, digital platforms mediate—and to a considerable extent, dictate—economic relationships and social action. By automating market exchanges they solidify relationships into material infrastructure, lend a degree of immutability and traceability to engagements, and render what previously would have been informal exchanges into much more formalised rules. In his Policy & Internet article “Platform Logic: An Interdisciplinary Approach to the Platform-based Economy”, Jonas Andersson Schwarz argues that digital platforms enact a twofold logic of micro-level technocentric control and macro-level geopolitical domination, while supporting a range of generative outcomes between the two levels. Technology isn’t ‘neutral’, and what designers want may clash with what users want: so it’s important that we take a multi-perspective view of the role of digital platforms in contemporary society. For example, if we only consider the technical, we’ll notice modularity, compatibility, compliance, flexibility, mutual subsistence, and cross-subsidisation. By contrast, if we consider ownership and organisational control, we’ll observe issues of consolidation, privatisation, enclosure, financialisation and protectionism. When focusing on local interactions (e.g. with users), the digital nature of platforms is seen to strongly determine structure; essentially representing an absolute or totalitarian form of control. When we focus on geopolitical power arrangements in the “platform society”, patterns can be observed that are worryingly suggestive of market dominance, colonisation, and consolidation. Concerns have been expressed that these (overwhelmingly US-biased) platform giants are not only enacting hegemony, but are on a road to “usurpation through tech—a worry that these companies could grow so large and become so deeply entrenched in world economies that they could effectively make their own laws.” We caught up with Jonas to discuss his findings: Ed.: You say that there are lots of different ways of considering “platforms”: what (briefly) are some of these different approaches, and why should they be linked up…