The Taylor Review of Modern Working Practices in the UK was published last week. The review assesses changes in labour markets and employment practices, and proposes policy solutions. One of the big themes in the report is the rise of platform-mediated gig work. I have been doing research on platform-mediated work for a few years now, and am currently leading a major European Research Council funded research project on the topic. This article is my hot take on some of the topics covered in the report. Overall the report takes a relatively upbeat view of the gig economy, but engages with its problematic points as well.

A third way in employment classification

In the U.S. policy debate around the gig economy, many have called for a ‘third category’ between protected employment and unprotected self-employment. The interesting thing is that in the UK such a category already exists. An employment tribunal decision last year determined that Uber drivers were not employees or contractors, but ‘workers’, enjoying some of the benefits of employment but not all. The review recommends making use this ‘worker’ category and renaming it ‘dependent contractor’.

The review calls for greater emphasis on control over one’s work as a factor in determining whether someone is a ‘dependent contractor’ or genuinely self-employed. The question of control has featured prominently in recent research on gig economy platforms (see, for example: Rosenblat & Stark 2016, Graham et al. 2017). Uber promises freedom, but in practice uses a variety of nudges and constraints to manage workers quite closely. Platforms for digitally delivered work like graphic design don’t necessarily try to control the workers in the same way at all. So focusing on control can help distinguish between the employment status implications of different platforms, which can be quite different.

Of course, the fact that someone is genuinely self-employed doesn’t necessarily mean that they are well off. Self-employed people are often relatively poor and suffer from unpredictability of income. So it’s good that the report also calls for extending more safety nets and other support to self-employed people (p. 74-81).

The report also calls for greater clarity in law, and for alignment of the definitions between different branches of law (employment law and tax law, p. 38). This seems like such an obvious thing to do. As someone coming from a civil law system, I have always marvelled at common law’s ability to evolve through court decisions, but that spontaneous and complex evolution has a price. As the Review states, many people in Britain don’t know their rights, and even if they do, it is often prohibitively expensive to pursue them.

Fair piece rates

The Review’s section on piece rates (p. 38) is very interesting and in many ways forward-looking, but likely to cause contention.

Piece rates mean that workers are paid on the basis of the number of tasks completed (e.g. meals delivered) rather than on the basis of hours worked. This is how many gig work platforms function today. The Review suggests that platforms be required to use their data to calculate how much a worker can earn per hour from such piece rates, given what they know about the demand for the tasks and how long it usually takes to complete them. Based on this calculation, platforms would be required to set their piece rate so that on average it produces an hourly rate that clears the National Minimum Wage with a 20% margin of error.

One argument likely to be put forward in opposition is that since platforms have all the data necessary to calculate the average hourly rate, why don’t they just pay the average hourly rate instead of the piece rate? As the Review notes, piece rates are used in work where the employer cannot monitor the hours worked, such as for people who fill envelopes with information for mailshots from home. Platforms usually monitor their pieceworkers intensively, so they could just as well pay hourly rates.

I think this is a fairly strong argument, but not without its limits. Piece rates are a substitute for more direct managerial control. Employers who pay hourly rates are pickier about whom they accept into their ranks in the first place, whereas one of the strengths of these platforms is that essentially anyone can sign up and start working right away with a minimal hurdle. And workers who are paid on an hourly basis usually cannot take breaks quite as easily as pieceworkers. This low entry barrier and potential for almost minute-by-minute flexibility are genuine features of platform-based piecework, and some workers value them.

I say potential for flexibility, because actual flexibility for the worker depends on how much work there is available on the platform, as I discuss in an upcoming paper. Pieceworkers also have to put more effort into managing their own time than regular workers, though platform design can ameliorate this.

Flexibility or erosion?

The Review moreover suggests that platforms should be allowed to offer piecework at times when demand is so low as to result in hourly earnings below minimum wage, as long as the worker is fully informed of this. To quote: “If an individual knowingly chooses to work through a platform at times of low demand, then he or she should take some responsibility for this decision.” (p. 38) This is likely to be a very contentious point.

On the one hand, the report is using an old trope of laissez-faire labour policy: if the worker chooses to work for such low pay, or in such terrible conditions, who are we to stop them? Yet such choices are not independent, but shaped by and constitutive of wider structural forces. If there is nothing else on offer, of course the worker will rather accept a pittance than starve; but if every labourer accepted a pittance, soon employers would find it necessary to offer little else. The minimum wage must thus remain inviolable as a bulwark against exploitation, goes the labour movement refrain.

On the other hand, it is probably also true that much of the work that is available on platforms during off-hours will simply not be done if the cost is higher (and indeed was not done before platforms arrived). Eaters will cook at home or pick up a meal themselves instead of paying double for delivery. Part of the value of platforms is that they make marginal, low-value transactions at least somewhat feasible by matching interested parties and bringing down transaction costs. In doing so they grow the total pie of work available. As an incremental source of income for someone with another job or studies, these edges of the pie may be very appealing.

The challenge for policymakers is to prevent what is intended to be a side gig for students from becoming the desperate sustenance of families. In 1999, Japan deregulated the use of temporary contract workers, partly with the aim of helping students and housewives gain work experience and earn additional income to supplement the salaries of the male breadwinners, who enjoyed life-long employment. Less than a decade later, almost a third of the labour force found themselves on such contracts, including millions of breadwinners (Imai 2011).

The same pros and cons also apply to the idea of the third ‘dependent contractor’ category: it could help employers accommodate more diverse life situations and business models, but it could also represent an erosion of rights if regular employees eventually find themselves in that category. Early results from our ongoing research suggest that some Fortune 500 companies that are experimenting with online gig work platforms are not doing so with the intention of replacing regular employees, but as a complement and substitute to temporary staffing agencies. But statistics will be necessary to evaluate the wider impacts of platforms on labour markets and society.

Statistics on the gig economy

When it comes to statistics, the Review points out that “official data is not likely to include the increasing number of people earning additional money in a more casual way, through the use of online platforms for example” (p. 25). This is a real problem: official labour market statistics don’t capture platform-based work, or when they do, they don’t make it possible to distinguish it from ordinary self-employment income. This makes it impossible to properly evaluate the role that platforms are taking in the modern labour market.

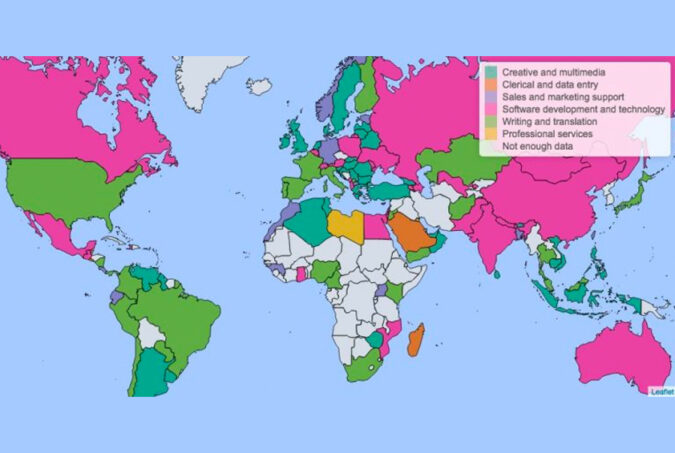

To help address this paucity of data, we have created the Online Labour Index, the first economic indicator that provides an online gig economy equivalent of conventional labour market statistics. It shows that the online gig economy grew by a whopping 26 percent over the past year, and that UK-based employers are among its leading users in the world. By online gig economy we refer to digitally delivered platform work like design, data entry, and virtual assistant services, rather than local services like delivery. The index is constructed by ‘scraping’ all the gigs from the six biggest platforms in real time and calculating statistics on them; a similar approach could possibly be used to create new statistics on the local gig economy, to complement inadequate official labour market statistics.

Open issues

There is much more in the 116-page review. For instance, the issue of flexibility gets a lot of attention, and is something that colleagues and I are also doing research on. The question of “flexibility for whom – workers or employers” will no doubt continue to feature in the debates on the future of work and employment.

I hope you enjoyed my hot take, and I hope to return to these topics in a future blog post!

***

Prof. Vili Lehdonvirta is an economic sociologist who studies the design and socioeconomic implications of digital marketplaces and platforms, using conventional social research methods as well as novel data science approaches. He is the Principal Investigator of iLabour, a 5-year research project funded by the European Research Council. @ViliLe